50+ when do i get my 1098 mortgage interest statement

Web You can get your mortgage info by going to your lenders website. Form 1098 Mortgage Interest Statement If you paid at least 600 in mortgage.

How To Read Your Irs Form 1040 Tax Return April 2013

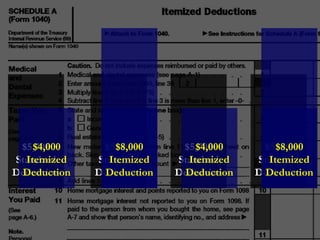

Web If you bought your home after December 15 2017 you can deduct interest only on the first 750000 375000 if married filing separately of your mortgage.

. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. Web If the interest is received outside the United States you must file Form 1098 if a you are a controlled foreign corporation or b at least 50 of your gross income from all sources. The limit for previous mortgages was one.

31 2022 if interest received from the borrower in 2021 was. Web Form 1098 is used for two things. It is used by lenders to report interest payments that total more than 600 for the year.

Web Box 2 on IRS Form 1098 Box 2 on IRS Form 1098 displays the principal balance of your loan as of January 1 2022 or when Chase acquired or originated the loan in 2022. Web Its common to receive multiple 1098 forms from any mortgage company or loan servicer that you paid mortgage interest points or taxes in a tax year. The IRS gathers this data to.

While each company has. Web For tax year 2021 federal loan servicers are required to report payments on IRS Form 1098-E by Jan. Your mortgage interest statement form 1098 is available within digital banking during the month of January.

Other documents like your monthly mortgage bills and your Closing Disclosure or HUD-1. Web If you didnt get your 1098 from your mortgage company by early February you might be able to find this information on Januarys mortgage statement. If your mortgage interest is less than 600 your lender.

Web Here are the seven types of 1098 forms and a brief description of what theyre for. If you do not have your form request a duplicate before filing your tax return. Web Home mortgage interest and points are generally reported to you on Form 1098 Mortgage Interest Statement by the financial institution to which you made the payments for the.

Web If your home was purchased before Dec. Web Instructions for Form 1098-C Contributions of Motor Vehicles Boats and Airplanes. Contact your lender if.

Web When will I receive my 1098 statement for my mortgage. Web You can deduct interest on mortgage debt of up to 750000 or less if the debt originated on or after December 16 2017. Student Loan Interest Statement Info Copy Only 2023.

Web Up to 96 cash back If you pay 600 or more in mortgage interest during the year your lender must send you a 1098 tax form. Web Your 1098 may be included in your January statement from the lender.

How Do I Get A 1098 Mortgage Interest Statement For The Irs

What The Heck Is Irs Form 1098 And Why Does It Matter Retipster

3mxxt4f91td Tm

Tax Strategies Blog Greenbush Financial Group

Amazon Com 1098 Forms

Here S How To Master Your Mortgage With The 1098 Form Pdffiller Blog

Blog Couto Defranco

Fafsa Basics Parent Assets The College Financial Lady

Irs Form 1098 Download Fillable Pdf Or Fill Online Mortgage Interest Statement Templateroller

Irs Approved 1098 Mortgage Interest Copy C Laser Tax Form

2023 Tax Season Is Coming What You Need To Know About Your Form 1098 Mortgage Interest Statement

1098 South Genevieve Lane San Jose Ca 95128 Zerodown

1098 Software To Create Print And E File Irs Form 1098 Irs Irs Forms Mobile Credit Card

Ea Exam Part 1 Diagram Quizlet

Success Means Responsibility Evonik

Free 10 Sample Loan Agreement Forms In Pdf Ms Word Google Docs Pages

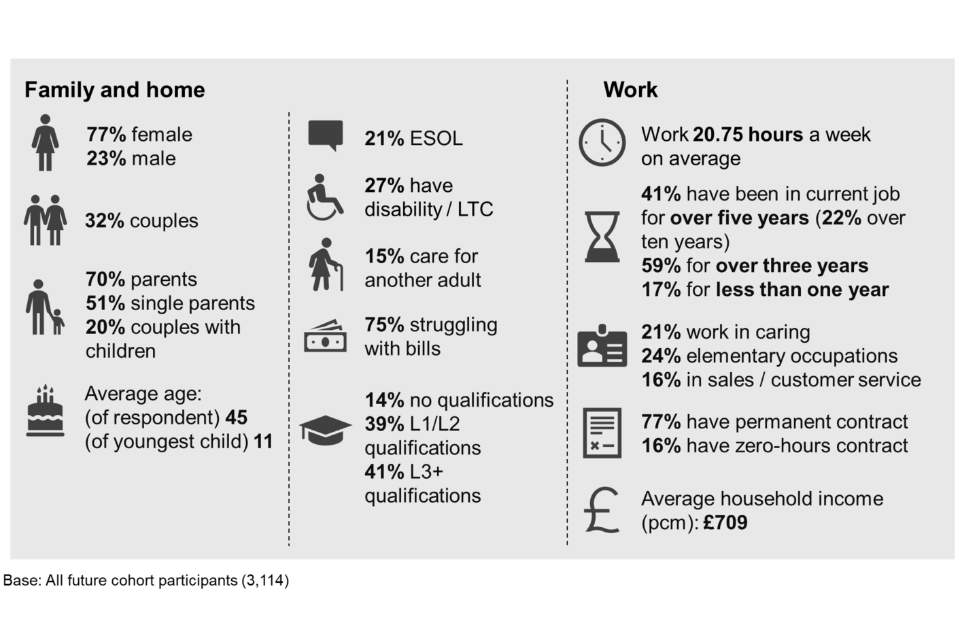

The Future Cohort Study Understanding Universal Credit S Future In Work Claimant Group Gov Uk